Outlook for the market outlook: September 7th is the US Labor Day, and the financial market will be closed for one day. Last Friday, the Dow Jones index, the S&P 500 index and the Nasdaq index once again returned to the monthly line, reversing the unfavorable technical situation. From the perspective of economy, the US ISM manufacturing index has returned to the expansion level of 50 or more. The pending home sales have been growing for 6 consecutive months, and the factory orders have seen positive growth for 4 consecutive months. These data all show that the US economy is recovering. The trend has not changed. It is estimated that the US GDP growth rate in the third quarter may be positive. From the perspective of industry, the S&P 500 enterprises in the second quarter profited by 72% better than expected. Recently, Dell and Intel reported the performance information, and the fundamentals are more optimistic. It is expected that the US stock market will be strong after the market.

Asia-Pacific market: A-shares have a bullish policy, Hong Kong stocks bottomed out

Outlook for the market outlook: As of September 4, there have been five AH-listed stocks that have been reversed in price. Among them, the H-shares of China Railway Construction have a 9% increase in A-shares, indicating that the Hong Kong stocks are loosely priced and started to be relative to A-shares. The market stability phenomenon, the other four files are China Life Insurance, Ping An Insurance, Anshan Iron and Steel and Conch Cement. At present, most of the funds concentrated in the industry are industry leaders, showing that the situation of excess liquidity is relatively obvious. We observe that the interbank rate of Hong Kong banks continues to decline, and it is judged that the trend of H shares in the next one to two months should remain relatively strong. Investors should be optimistic.

Indian market: Last week, many auto companies in the Indian market reported earnings. Almost all Indian auto stocks exceeded market expectations. Auto stocks rose across the board. However, we judged that the base period is already high this year. Maybe we should start thinking about whether there are other sectors. The valuation is relatively cheap; Monsoon, India's seasonal rain, has gradually caught up with the past average. The impact on agriculture may be less than expected. The impact is that the analysts who previously lowered the economic growth of India may have the need to revert back the numbers in the future. We believe that the impact of future consumption in India should not be as serious as imagined, and investors may be optimistic.

Observation focus this week

After entering September, the global stock market maintained its recent high-end shocks. The mature stock market (US, Europe and Japan), which had a strong performance in August, also saw profit-taking selling pressure last week. However, it is worth noting that the Chinese stock market has stopped falling, in the Shanghai Composite Index. After the high point fell more than 20%, investors' doubts about their stock market overestimation have eased slightly, and the Chinese government's timely movement of a number of bullish also boosted market confidence. From last week's market news, in addition to China's PMI as expected, the US ISM manufacturing index rose sharply to 52.9, much higher than expected, while the US employment report on Friday showed that the unemployment rate climbed to 9.7%. However, the rate of decline in the employment population has continued to slow down. If some industry news (such as the news of the technology industry in various regions) is added, there are indications that the global economy should still be on the recovery track.

In this week's important economic data, the United States can pay attention to unemployment benefits and consumer confidence at the beginning of the week. China is focusing on 9/11 to announce a large number of economic data. It is expected to be the focus of global attention. In addition, many central banks including the UK this week. Interest rate meetings will be held, and it is expected that interest rates will remain unchanged. In terms of industry news, all listed cabinet companies in Taiwan will announce their revenues for the previous month before 9/10, which will provide investors with a reference for assessing the heat of the end of the Christmas season.

In summary, the short-term stock market's multiple reversal is a reasonable phenomenon, and the performance of the medium and long-term stock market will ultimately depend on fundamentals. Investors are facing a more diversified and comprehensive configuration in the face of the recent round of fluctuations in asset classes, which will help reduce the risk of overall asset volatility.

1. Description of GH sand and gravel pump

Naipu G series Gravel and sand slurry pump is

designed specifically for continuous pumping of extremely aggressive

slurries, with a wide particle size distribution. Capable of handling

large particles at consistently high efficiencies results in low cost of

ownership. The large volume internal profile of the casing reduces

associated velocities further increasing component life.

Typical Applications---

Slag Granulation

Suction Hopper Dredging

Dredging

Barge Loading

Sand Reclamation

Sugar Beet

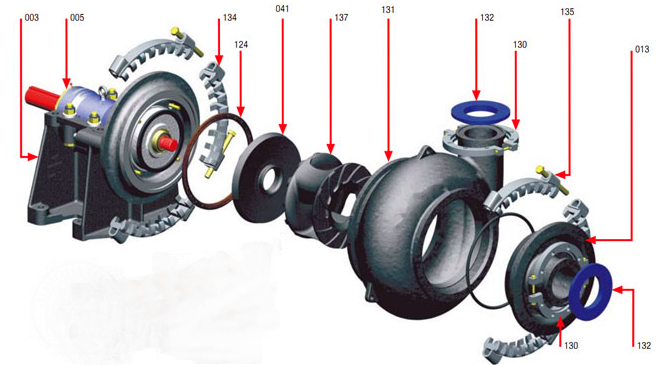

2. Construction drawing for Naipu GH sand and gravel pump

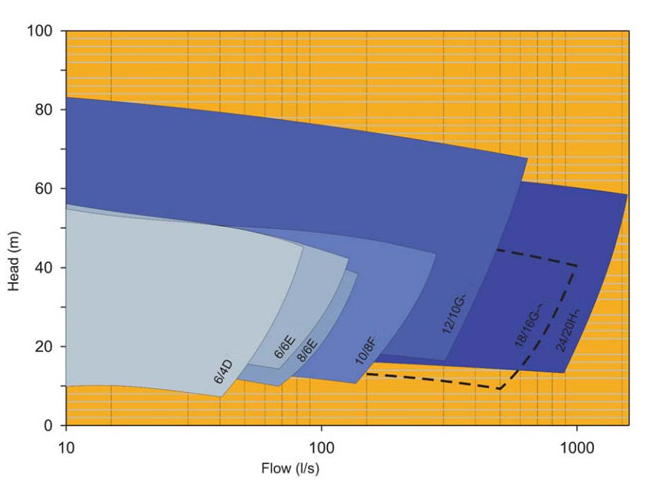

3. Select chart of GH sand and gravel pump

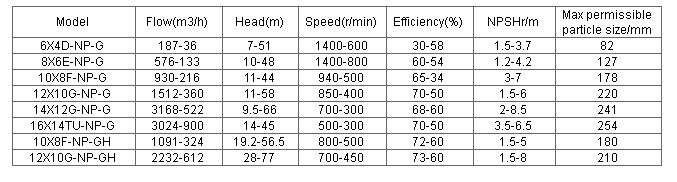

4.Performance parameters of GH sand and gravel pumps

Gravel Pump, Sand Pump,High Head Gravel Pump,GH Gravel Pump,Dredging Pump,Sand Gravel Pump

Shijiazhuang Naipu Pump Co., Ltd. , https://www.naipu-pump.com

![<?echo $_SERVER['SERVER_NAME'];?>](/template/twentyseventeen/skin/images/header.jpg)